santa clara county property tax collector

East Wing 6 th Floor. San Jose CA 95110.

MondayFriday 900 am400 pm.

. Currently the average tax rate is 079. Sales of secured roll information. Santa Clara County Government Center.

Click here to contact us. MondayFriday 800 am 500 pm. District Attorney Jeffrey Rosen.

The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Ad Need Property Records For Properties In Santa Clara County. 12345678 Enter Property Address this is not your billing address.

Look up and pay your property taxes online. You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes. Learn why Santa Clara County was ranked a top 40 Healthiest Community by US.

Business Property Statement Filing Period. Enter Property Address this is not your billing address. Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square.

The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. And reconciliation of the extended tax roll prior to certifying to the tax collector for tax bill printing mailing and collecting. Currently you may research and print assessment information for individual parcels free of charge.

The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. Doing Business As. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

The Assessors Office allows residents to view free of charge basic information about properties in Santa Clara County such as assessed value assessors parcel number APN document number property address Assessor parcel maps and other information. Last Day to file Business Property Statement without 10 Penalty. County Assessor Lawrence E.

These escape bills are usually the result of a taxable event that escaped the Office of the Assessor. They are maintained by various government offices in Santa Clara County California State and at the Federal level. Property tax billing questions.

Photo by Newsha Naderzad. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or. Find Information On Any Santa Clara County Property.

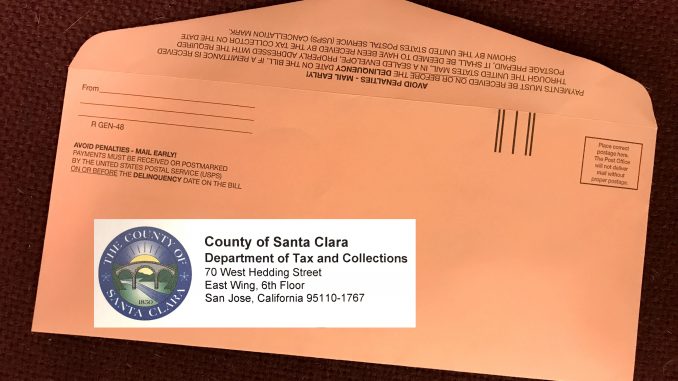

Doing Business As. County Government Center East Wing 5th Floor 70 West Hedding Street San Jose CA 95110. Send us a question or make a comment.

Some property andor parts thereof may be subject to a special exemptionsuch as those for veterans or non-profit organizations like churches or hospitals. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Santa Clara Countys longtime assessor is squaring off with a younger opponent who wants to shake up the office.

The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts. View and pay for your property tax billsstatements in Santa Clara County online using this service. All businesses that are eligible to e-file or utilize SDR are urged to.

E-Filing your statement via the internet. 1 2022 - May 9 2022. 2022 County of Santa Clara.

This information is available on-line by. Below is more information about each of these different methods for filing your property statement. Due Date for filing Business Property Statement.

Enter Property Parcel Number APN. Incumbent Larry Stone has been assessor of Santa Clara County for 27 years and he is seeking a seventh term to take him into his third decade in office. Click here to register it now.

Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square. An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual Unsecured Property Tax Bill. There are three ways to file the Business Property Statements 571-L 1.

News and World Report. Parcel Maps and Search Property Records. Standard Data Record SDR.

A payment drop slot is located on the southeast corner of the building near the entrance adjacent to the parking lot. Closed on County Holidays. April 27 2022.

12345678 Enter Account Number. Pay Property Taxes. Standard paper filing 3.

Currently you may research and print assessment information for individual parcels free of charge. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Save time - e-File your Business Property Statement.

70 West Hedding Street. They are a valuable tool for the real estate industry offering. Last Payment accepted at 445 pm Phone Hours.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

Santa Clara County Property Tax Tax Assessor And Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Info Santa Clara County Secured Property Tax Search

Commercial Property Tax Shannon Snyder Cpas

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Search And Records Propertyshark

Info Santa Clara County Secured Property Tax Search

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019